Real Estate vs Stocks : Living in the UAE opens the door to higher salaries and lucrative financial opportunities. However, deciding where to invest real estate or stocks can be confusing. Both come with risks and rewards, and it’s important to do your research before taking the plunge. Whether you’re an expat planning to stay long-term or simply looking to grow your savings, understanding the Dubai property market and stock investments can help you make smarter financial decisions.

Key Similarities Between Real Estate and Stock Investments

Both real estate investment in Dubai and stock trading require patience and a long-term mindset. Market fluctuations can impact both sectors, but steady investors who ride out volatility often see stronger returns. In both cases, professional advice can also make a huge difference whether from a certified financial adviser or a trusted real estate agent in Dubai who understands property values, mortgage options, and ROI potential.

Why Real Estate Investment in Dubai Stands Out

One of the biggest advantages of buying property in Dubai is that it’s a tangible asset something you can own, live in, or rent out. Unlike stocks, your property value is not just on paper. Dubai’s off-plan projects also make it easier for investors to own property at lower prices while customizing layouts and features. With mortgage options and stable regulations, owning real estate becomes a strategic way to build long-term wealth in the UAE.

Real Estate Returns for Investors

Investors in Dubai property benefit from consistent rental yields and growing capital appreciation. Prime areas such as Downtown Dubai and The Springs are delivering higher ROI year after year. By comparing purchase prices with rental income, investors can easily estimate their returns using tools like mortgage calculators. With strict regulations and construction-linked payment plans, Dubai has become a safe and profitable market for both local and international investors.

The Benefits of Investing in Stocks

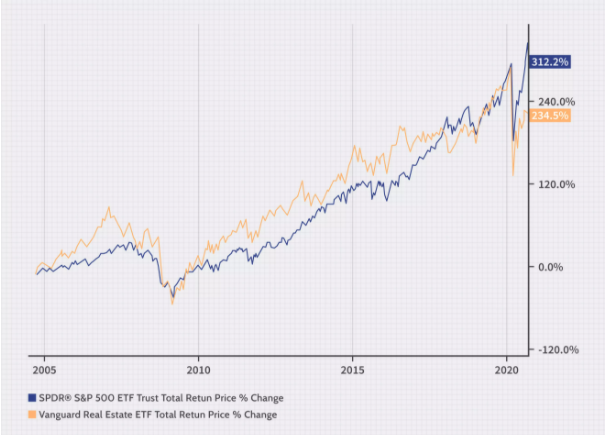

On the other hand, stock investments in the UAE offer flexibility and accessibility. You can start small, diversify your portfolio, and take advantage of global market growth. Historically, stocks have delivered around 10% annual returns before inflation, proving that they can outperform many asset classes over time. However, short-term volatility means investors need patience and solid market understanding to achieve long-term success.

Real Estate or Stocks?

When comparing stocks vs real estate in Dubai, the ideal approach may be a balance of both. Real estate provides stability and tangible growth, while stocks offer liquidity and faster compounding potential. For those with limited capital, starting small in stocks might be wise, whereas those seeking long-term security may prefer the Dubai property market. Either way, making informed choices with proper guidance ensures your investment journey in the UAE is a rewarding one.